User acquisition costs present a growing challenge for software companies. The increasing competition in the market has pushed the average cost of acquiring new users to unprecedented levels. For many software businesses, especially in the SaaS sector, finding cost-effective acquisition strategies has become a top priority.

We’ve worked with numerous software companies and seen firsthand how the right marketing approach can dramatically impact growth. From our experience with digital marketing services, we understand that software companies face unique challenges in attracting and converting users. The strategies that work for other industries often need significant modification for software marketing success.

This comprehensive guide explores the most effective marketing strategies for software companies looking to scale user acquisition while maintaining reasonable costs. We’ll examine current industry benchmarks, proven acquisition channels, and optimization techniques that drive sustainable growth.

Understanding User Acquisition Costs in the Software Industry

Customer acquisition cost (CAC) represents the total expense of acquiring a new customer. For software companies, this metric is particularly crucial due to the subscription-based nature of many software business models. Tracking and optimizing CAC directly impacts profitability and growth potential.

Recent data shows that the average customer acquisition cost across all SaaS businesses is $702. (Source: Userpilot)

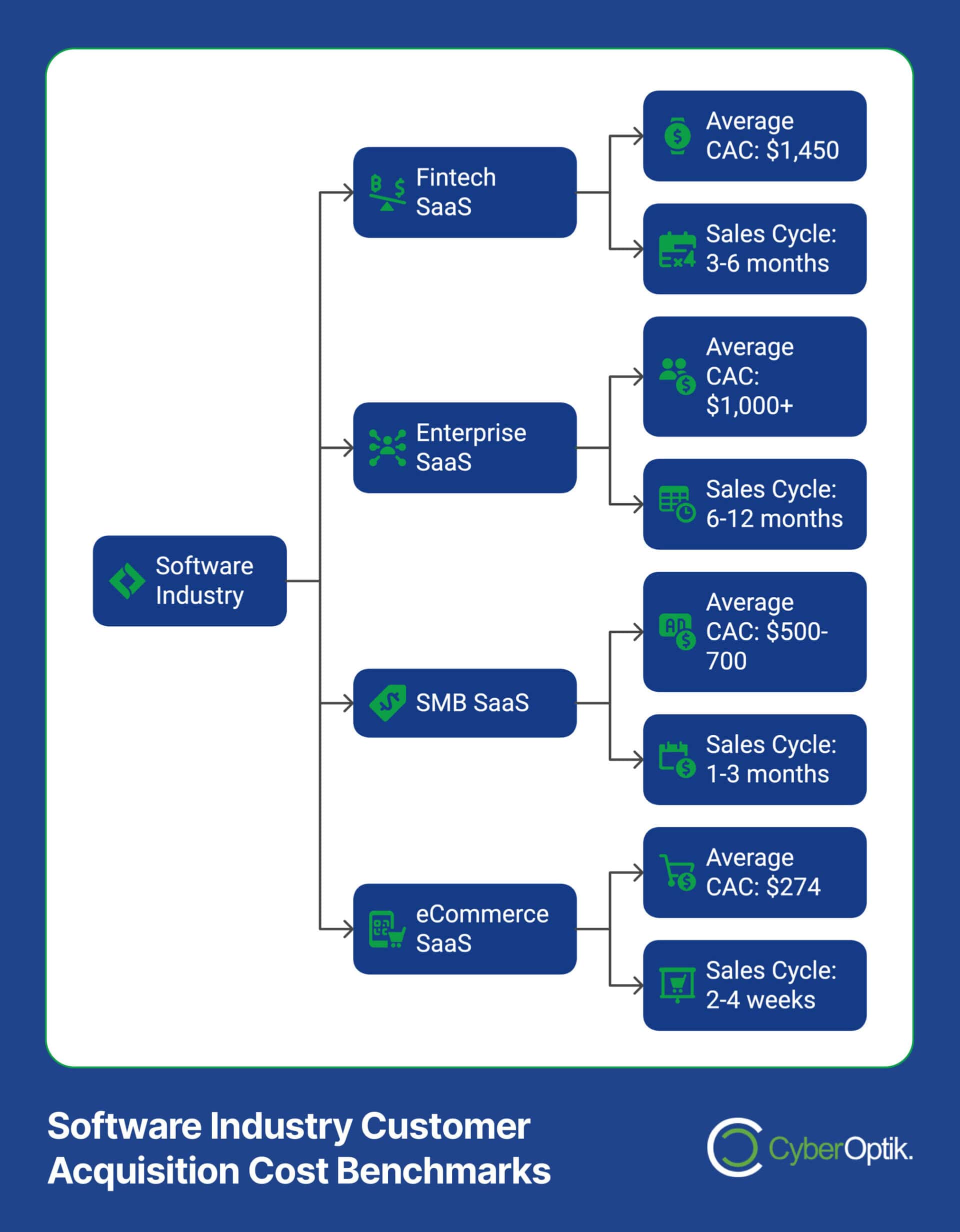

This figure varies significantly by software category and target market. Fintech SaaS companies face the highest acquisition costs at approximately $1,450 per customer, while eCommerce SaaS solutions enjoy lower CAC at around $274. (Source: Userpilot)

Several factors influence these acquisition costs. Enterprise software typically costs more to sell due to longer sales cycles and multiple decision-makers. Consumer software benefits from shorter sales cycles but faces intense competition for attention. B2B software falls somewhere in between, with costs varying based on complexity and pricing.

The following table breaks down typical CAC benchmarks across different software categories:

| Software Category | Average CAC | Typical Sales Cycle | Key Cost Factors |

|---|---|---|---|

| Fintech SaaS | $1,450 | 3-6 months | Regulatory requirements, trust-building |

| Enterprise SaaS | $1,000+ | 6-12 months | Multiple stakeholders, complex sales process |

| SMB SaaS | $500-700 | 1-3 months | Competitive market, price sensitivity |

| eCommerce SaaS | $274 | 2-4 weeks | Clear ROI metrics, shorter decision process |

Understanding these benchmarks helps software companies set realistic acquisition targets. Market position, product complexity, and target customer all influence what constitutes a “good” CAC for your specific business. The key is not necessarily having the lowest CAC, but rather ensuring your acquisition costs align with customer lifetime value.

Establishing Effective User Acquisition Goals and Metrics

Setting clear acquisition goals starts with understanding the relationship between costs and value. The most important metric beyond CAC is the CAC:LTV ratio. For growth-stage software companies, a healthy target is a 1:3 ratio, meaning a customer’s lifetime value should be at least three times the cost to acquire them. (Source: MADX Digital) More established, mature software businesses should aim for a 1:4 or even 1:5 ratio to ensure proper profitability.

Software companies need a comprehensive measurement framework to track acquisition effectiveness. This goes beyond simple cost metrics to include conversion rates at each funnel stage, channel performance, and retention indicators. Why do digital marketing strategies deliver better ROI for software companies than traditional methods? The answer lies in better attribution and measurement capabilities.

When establishing metrics, consider these four key areas:

- Acquisition efficiency: CAC, CAC:LTV ratio, CAC payback period

- Channel performance: Cost per lead, conversion rates by channel

- Engagement quality: Trial activations, feature adoption rates

- Retention indicators: Churn rate, expansion revenue, NPS scores

The table below outlines essential metrics every software company should track to evaluate acquisition effectiveness:

| Metric Category | Key Metrics | Target Benchmarks | Measurement Frequency |

|---|---|---|---|

| Acquisition Efficiency | CAC, CAC:LTV Ratio, Payback Period | 1:3 ratio (growth), 12-18 month payback | Monthly |

| Channel Performance | CPL, CPC, Channel CAC | Varies by channel (compare to industry) | Weekly |

| Conversion Quality | Visitor→Lead→Trial→Paid conversion rates | 1-3% visitor→paid (varies by model) | Weekly |

| Retention Health | Churn rate, Expansion MRR, NPS | <5% monthly churn, positive NPS | Monthly |

One often overlooked metric is software license utilization. Research shows that 53% of SaaS licenses go unused. (Source: GoCustomer.ai) This indicates a significant opportunity for optimization – both in targeting the right customers and in improving onboarding and activation processes. Monitoring utilization helps identify friction points in your user acquisition funnel.

The most successful software companies maintain a balanced scorecard approach. They track leading indicators (like website traffic and demo requests) alongside lagging metrics (like conversion rates and LTV). This provides both early warning signals and confirmation of strategy effectiveness.

Content Marketing Strategies for Software Companies

Content marketing provides exceptional value for software companies. It builds authority, educates potential users, and creates organic acquisition channels that reduce CAC over time. With properly optimized content marketing strategies, software companies can significantly reduce acquisition costs.

Effective software content marketing follows these principles:

- Address specific pain points: Create content that directly addresses the challenges your software solves. This attracts qualified prospects already searching for solutions.

- Demonstrate expertise: Showcase your deep understanding of the problem space through detailed, authoritative content. This builds trust before the sales conversation begins.

- Provide actionable value: Offer genuinely helpful information that prospects can use immediately, even without your software. This creates goodwill and positions your brand as a trusted advisor.

- Create content for each funnel stage: Develop awareness content for broad reach, consideration content for evaluation, and decision content for conversion.

Let’s examine the most effective content formats for software marketing:

- Educational content: How-to guides, industry reports, and best practice articles that establish authority while educating prospects about the problem space.

- Use cases and case studies: Detailed examples showing how your software solves real-world problems, with specific outcomes and ROI metrics.

- Technical documentation: Well-crafted API docs, integration guides, and knowledge bases that make implementation and adoption easier.

- Comparison content: Honest, value-focused comparisons with alternatives that help buyers make informed decisions.

- Video demonstrations: Visual walkthroughs showing your software in action, focusing on key value propositions and user benefits.

Distribution channels matter as much as the content itself. Software companies should create content hubs where prospects can find comprehensive resources. This includes regularly updated blogs, resource centers, and knowledge bases. Email nurture sequences help move prospects through the funnel by delivering relevant content based on their stage and interests.

For B2B software companies, LinkedIn has proven particularly effective for content distribution. Creating optimized LinkedIn profiles for key team members and regularly publishing thought leadership content can significantly expand reach to decision-makers.

Remember that content marketing is a long-term strategy. While it won’t deliver immediate results like paid acquisition, it creates sustainable advantages over time. Many software companies see their content marketing CAC decrease by 30-50% after 12-18 months of consistent investment and optimization.

Paid Acquisition Channels for Software Companies

Paid acquisition channels offer predictable, scalable ways to reach potential users. However, costs can add up quickly without proper strategy and optimization. Software companies should approach paid channels with clear goals, rigorous testing, and continuous refinement.

The mobile app space offers some insights into acquisition costs. On iOS platforms, the cost per install averages $4.50, while Android installations cost around $3.20. (Source: Business of Apps) These figures vary significantly by region and app category, with casual gaming apps on Android costing as little as $0.65 per install. (Source: Liftoff)

Regional variations in acquisition costs can be substantial. In North America, iOS installation costs reached peaks of $5.35 per month in April 2023, while Android costs remained relatively stable at approximately $0.81 per month. (Source: Statista) These fluctuations highlight the importance of platform-specific strategies and regional targeting.

Going Deeper

Discover how top-performing SaaS websites structure their conversion funnels to maximize sign-ups.

The most effective paid channels for software companies include:

- Search Engine Marketing (SEM): Targeting high-intent keywords related to the problems your software solves. Effective for bottom-of-funnel acquisition when prospects are actively seeking solutions.

- Social Media Advertising: LinkedIn for B2B software, Facebook/Instagram for B2C and SMB solutions. Advanced targeting options allow for precise audience definition.

- Retargeting Campaigns: Following up with website visitors, trial users, or those who abandoned sign-up processes. These campaigns typically have lower CAC than cold acquisition.

- Programmatic Display: Using data-driven platforms to place ads across relevant websites where your target users spend time.

- Sponsored Content: Placing expert content in industry publications and newsletters read by your target audience.

The comparison table below highlights key differences between these paid channels:

| Paid Channel | Typical CAC Range | Best For | Optimization Focus |

|---|---|---|---|

| Search (SEM) | Medium-High | Bottom-funnel, solution-aware prospects | Keyword selection, ad-to-landing page relevance |

| LinkedIn Ads | High | B2B, enterprise, professional tools | Job title/seniority targeting, content quality |

| Facebook/Instagram | Medium | B2C, prosumer, visual products | Creative testing, audience refinement |

| Retargeting | Low-Medium | Warming up engaged prospects | Segmentation, sequential messaging |

| Sponsored Content | Medium-High | Thought leadership, authority building | Publication selection, content value |

The comparison table below highlights key differences between these paid channels:For most software companies, a multi-channel approach works best. Start with 2-3 channels where your audience is most active, establish measurement systems, and run controlled experiments before scaling investment. The concept of conversion rate optimization is particularly important for software companies with longer sales cycles.

Budget allocation should follow performance data. Establish clear CAC targets for each channel and reallocate budget from underperforming channels to those showing the best results. This continuous optimization approach helps prevent wasted spend while maximizing acquisition efficiency.

Organic Acquisition Strategies

Organic acquisition strategies build sustainable growth channels that typically improve in efficiency over time. While they require patience and consistent investment, these approaches often yield the lowest long-term CAC for software companies.

SEO represents one of the most valuable organic channels for software businesses. By ranking for problem-focused keywords, companies can capture high-intent traffic at the exact moment prospects are seeking solutions. Technical SEO, content optimization, and backlink building all contribute to search visibility. Creating engaging content that converts visitors into leads is essential for maximizing SEO returns.

Community building provides another powerful organic acquisition strategy. Software companies can create user communities through:

- Discussion forums: Dedicated spaces for users to share knowledge and solve problems together

- Slack/Discord groups: Real-time community interaction channels

- User meetups: Virtual or in-person events bringing users together

- Developer communities: Technical spaces for implementation discussions (for developer tools)

These communities generate word-of-mouth referrals, provide product feedback, and create strong retention hooks – all contributing to improved CAC:LTV ratios.

Partnership and integration marketing leverages existing platforms and complementary tools. By integrating with popular software solutions your target users already employ, you can tap into established user bases. Creating marketplace listings, building public integrations, and developing co-marketing campaigns with partners can significantly reduce acquisition costs.

The table below compares organic acquisition strategies by time investment and expected results:

| Organic Strategy | Time to Results | Long-term CAC Impact | Resource Requirements |

|---|---|---|---|

| SEO | 6-12 months | Very positive (50-70% reduction) | Content creators, SEO expertise, patience |

| Community Building | 3-9 months | Positive (30-50% reduction) | Community managers, platforms, regular engagement |

| Partnership Marketing | 1-6 months | Positive (20-40% reduction) | Partnership team, integration resources |

| Content Marketing | 6-18 months | Very positive (40-60% reduction) | Content team, distribution channels |

Product-led growth (PLG) represents another powerful organic acquisition strategy for software companies. By making the product itself the primary driver of acquisition, companies can reduce marketing costs while improving conversion quality. Free trials, freemium models, and self-service onboarding all support PLG strategies.

The most effective PLG approaches include:

- Feature-limited free plans: Providing core value while reserving premium features for paid tiers

- Time-limited trials: Offering full access for a defined period to demonstrate complete value

- Open-source cores: Making basic functionality available open-source while selling premium features

- In-product virality: Building sharing, collaboration, or referral mechanisms directly into the product

Companies using PLG strategies typically see 30-50% lower CAC compared to pure sales-led approaches. The acquisition cost savings come from reduced sales involvement in early funnel stages and higher-quality prospects entering the pipeline.

Conversion Optimization for Software User Acquisition

Conversion optimization represents one of the most cost-effective ways to improve acquisition efficiency. Even small improvements in conversion rates can significantly reduce CAC without requiring additional marketing spend.

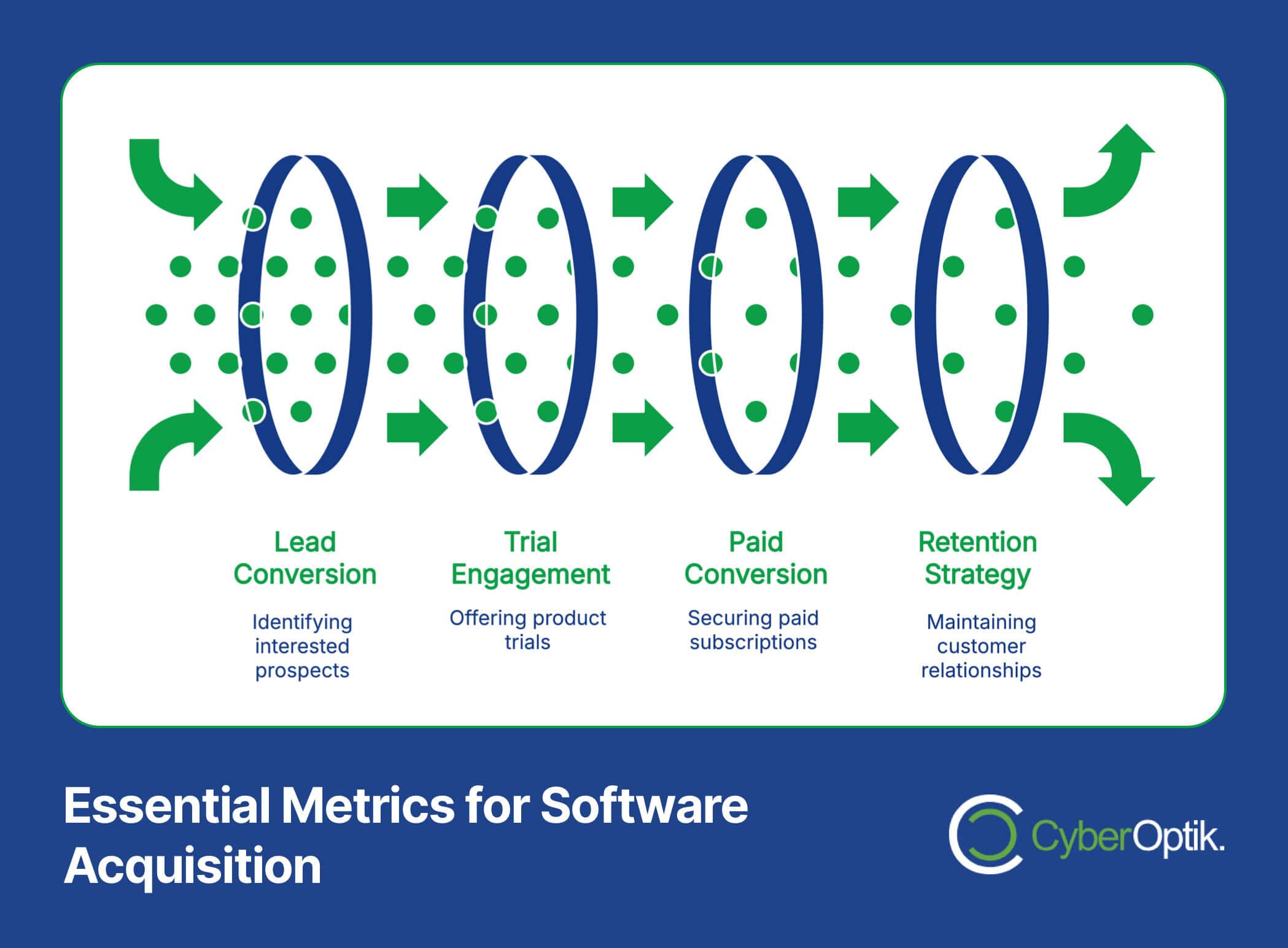

For software companies, the conversion process often involves multiple touchpoints:

- Initial interest capture: Newsletter signup, content download, or tool usage

- Product exploration: Free trial signup, demo request, or freemium usage

- Conversion to paid: Trial conversion, subscription purchase, or plan upgrade

Each step presents optimization opportunities. The most successful software companies continuously test and refine these conversion points.

Landing page optimization delivers some of the biggest conversion improvements. Key elements to test include:

- Value proposition clarity: Ensuring your unique benefits are immediately clear

- Social proof placement: Strategically positioning testimonials, logos, and case studies

- Call-to-action design: Testing button text, placement, and surrounding elements

- Form optimization: Finding the right balance between information collection and friction reduction

- Trust indicators: Adding security badges, reviews, and guarantees to build confidence

Free trial and freemium models require specific optimization approaches. The goal isn’t just getting signups, but ensuring users experience value quickly. This requires thoughtful onboarding flows, activation triggers, and engagement campaigns.

For demo and consultation requests, qualification mechanisms help balance volume with quality. Progressive profiling, where information is collected in stages, can increase initial conversion while still gathering necessary qualification data.

The onboarding experience significantly impacts conversion to paid usage. Software companies should focus on:

- Time-to-value acceleration: Helping users reach their first “wow” moment as quickly as possible

- Contextual guidance: Providing help when and where users need it

- Progress indicators: Showing users how far they’ve come and what’s next

- Success celebrations: Acknowledging achievements to reinforce value

- Personalized journeys: Tailoring the experience to specific user needs and use cases

Companies that excel at onboarding optimization typically see 30-50% higher trial-to-paid conversion rates than industry averages. This directly translates to lower effective CAC and faster growth.

Measuring and Optimizing Your Acquisition Strategy

Effective measurement forms the foundation of sustainable user acquisition. Software companies need robust attribution models to understand which channels and touchpoints drive valuable conversions.

Most software businesses should implement multi-touch attribution models that consider the entire customer journey. Single-touch models (like first or last touch) fail to capture the complexity of B2B and SaaS buying processes. Advanced attribution approaches include:

- Linear attribution: Equal credit to all touchpoints in the conversion path

- Time-decay attribution: More credit to touchpoints closer to conversion

- Position-based attribution: More credit to first and last touchpoints

- Algorithmic attribution: Machine learning-based weighting of touchpoints

The right model depends on your sales cycle length and typical customer journey. Shorter, simpler journeys can use simpler models, while complex enterprise sales require more sophisticated attribution.

A/B testing provides the clearest path to continuous improvement. Software companies should establish a regular testing cadence covering:

- Value proposition messaging: Testing how you communicate core benefits

- Channel mix optimization: Comparing performance across acquisition channels

- Landing page elements: Testing design, copy, and conversion elements

- Offer structures: Comparing trial lengths, freemium limitations, etc.

- Pricing presentation: Testing how pricing is displayed and structured

The most successful companies maintain an experimental mindset. They recognize that 60-70% of tests will show no significant improvement or even negative results. The value comes from the 30-40% of winning tests that compound over time to create significant advantages.

When optimizing, focus on these high-impact areas:

- Targeting refinement: Increasing audience relevance usually improves all downstream metrics

- Message-to-market match: Ensuring your messaging resonates with specific segment needs

- Friction reduction: Removing unnecessary steps in the conversion process

- Value demonstration: Finding better ways to show your solution’s benefits

Finally, know when to pivot. If a channel or strategy consistently underperforms despite optimization efforts, be willing to reallocate resources. The most effective software marketing organizations maintain 70% of budget in proven channels while testing new approaches with the remaining 30%.

Conclusion

Scaling user acquisition presents both challenges and opportunities for software companies. The rising cost of acquisition across the industry makes strategic marketing more important than ever. By focusing on the right metrics, channels, and optimization approaches, software businesses can achieve sustainable growth while maintaining healthy economics.

The most successful companies combine multiple strategies:

- They build strong content foundations that generate organic traffic and authority

- They leverage paid channels strategically, with rigorous measurement and optimization

- They continuously improve conversion paths to maximize return from existing traffic

- They implement product-led mechanisms that reduce friction and encourage organic sharing

Most importantly, they maintain a data-driven approach to marketing decisions. They track key metrics like CAC, CAC:LTV ratio, and channel performance to guide resource allocation and strategy refinement.

For software companies looking to improve their user acquisition efforts, start with a comprehensive audit of your current channels and performance. Identify the highest-potential opportunities based on your specific business model, target audience, and market position. Then develop a systematic testing plan to improve performance across the acquisition funnel.

Remember that sustainable growth comes from balanced investment across the customer journey. While acquisition is vital, retention and expansion often deliver even greater ROI. The most valuable marketing strategies connect acquisition efforts to the entire customer lifecycle, creating systems that not only attract users but turn them into loyal advocates.

By applying these strategies and continuously measuring results, software companies can navigate the challenging acquisition landscape while building sustainable competitive advantages.