Buying a home is one of the most significant financial decisions most people will ever make, and the mortgage industry is at the heart of helping homeowners realize their dreams. A well-designed mortgage website is critical for educating prospective borrowers, demonstrating trustworthiness, and making the application process smooth and efficient. Whether you specialize in traditional loans, refinancing, or specialized lending, your online presence needs to convey expertise and reliability from first glance. If you’re looking to create or revamp your mortgage website, check out these insights to give you a competitive edge.

Mortgage broker websites must reflect clarity and confidence. When visitors arrive at your homepage, they want to understand quickly what products you offer, why they should trust you, and how to get started. By blending modern web design elements—such as intuitive navigation, responsive layouts, and strong calls to action—you can make the process less daunting for potential clients. Moreover, including up-to-date mortgage rates and easy-to-use calculators can further encourage visitors to explore financing options right on your platform.

Finally, successful mortgage company websites offer more than just the basics. They position the brand as an industry authority by featuring relevant blog content, industry news, customer testimonials, and detailed loan resources that help guide prospects through the often complicated world of mortgages. If your site can cater to each stage of the buyer’s journey with clarity, transparency, and a splash of creativity, you’ll be well on your way to having one of the best mortgage websites in the industry.

Examples of the Best Mortgage Website Designs

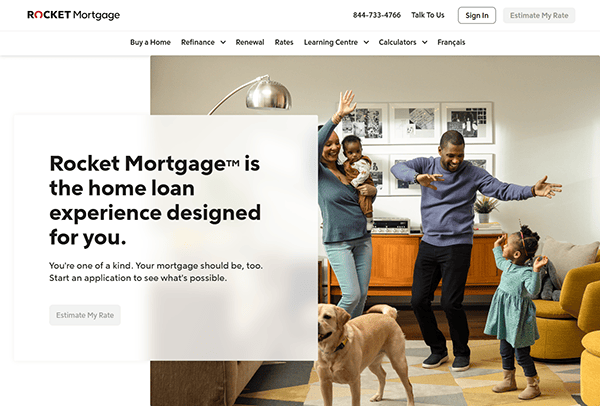

- Rocket Mortgage: Quicken Loans, famously known for its Rocket Mortgage brand, offers a user experience that is both innovative and straightforward. Their homepage features a simple form inviting visitors to “Get Started,” immediately funneling potential clients toward checking rates and loan options. The site’s navigation is remarkably clear, guiding users to learn about different mortgage types, refinancing solutions, and helpful calculators. Bright, modern design elements instill trust from the outset, and the ample white space keeps the site uncluttered. Their advanced digital process showcases how tech-driven mortgage websites can transform paperwork-heavy processes into a speedy, transparent online experience.

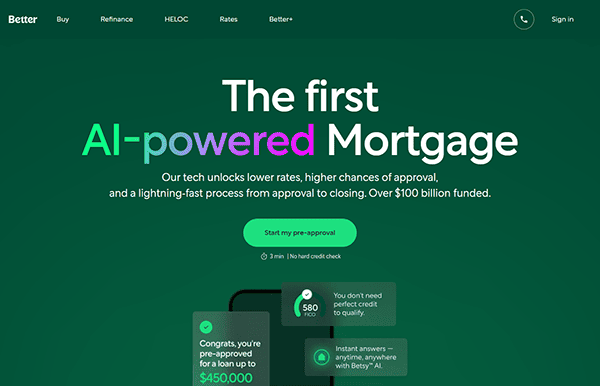

- Better.com: Better.com is known for its streamlined digital approach, and their website perfectly reflects that ethos. With a bold color palette and concise copy, visitors can easily explore various mortgage products without feeling overwhelmed. The platform offers real-time rate comparisons, automated underwriting features, and a chat function for immediate support—an excellent example of how mortgage broker websites can integrate modern customer service tactics. Additionally, Better.com incorporates educational blog posts that clarify lending terminology, loan processes, and refinancing options. By focusing on upfront savings, transparency, and speed, they create a genuinely user-centric mortgage experience.

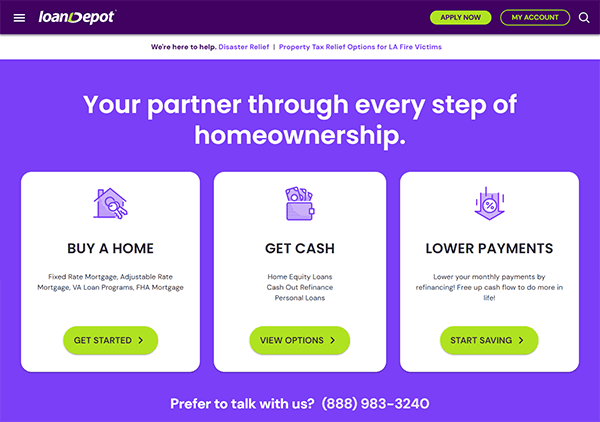

- LoanDepot: LoanDepot’s clean and welcoming website greets visitors with a straightforward “Get Started” call to action, guiding them smoothly into the loan inquiry process. Rich visuals highlight the platform’s variety of loans, and well-organized sections detail conventional, FHA, VA, and jumbo loan options. The site balances strong branding with a sincere tone, reinforcing that LoanDepot is a caring partner in the mortgage process. Testimonials and success stories demonstrate trustworthiness, while helpful tools—like mortgage calculators—ensure that users receive immediate value. The easily navigable layout and prominent phone number reflect a commitment to making mortgage journeys as convenient as possible.

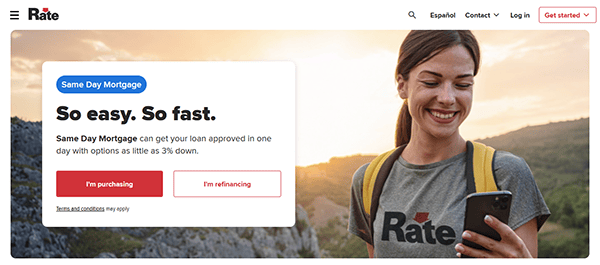

- Guaranteed Rate: Guaranteed Rate stands out for its vibrant design, user-friendly interface, and focus on simple rate quotes. Visitors can quickly explore customized rate options from the homepage based on basic personal data. Their streamlined process is a testament to how mortgage company websites can reduce the typical hassles borrowers face. Borrowers can find step-by-step instructions about securing a loan or completing a refinance, supplemented by customer testimonials that lend authenticity. Tools like “mortgage calculators” and “loan comparison” are integrated seamlessly, and a thoroughly modern layout—highlighting success stories—boosts brand recognition and reliability.

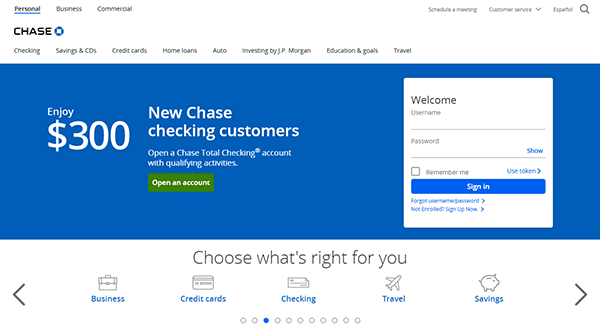

- Chase Mortgage: Chase Mortgage’s website exemplifies how a major financial institution can balance brand consistency with specialized mortgage content. The dedicated mortgage section uses helpful graphics, direct calls to action, and an easy-to-follow application process. Their page includes an extensive resource library covering everything from first-time homebuyer advice to refinancing details. This layout proves that large banks can make mortgage sites approachable with the right copywriting and design choices. Chase’s mortgage calculators, loan comparison charts, and educational articles offer the depth visitors need to make informed decisions, while the convenient login portal streamlines ongoing account management.

- Wells Fargo Home Mortgage: Wells Fargo significantly emphasizes customer support and guidance. The website’s landing page is direct, providing immediate access to loan types and an overview of mortgage rates. By weaving in personal success stories and an online mortgage application option, visitors can feel confident in exploring various mortgage solutions. The “check rates” button is prominently featured, reflecting a strong user-first approach. Their resource section touches on credit guidance and repayment strategies, showing that the site isn’t just about selling loans—it’s about providing robust educational tools. Overall, it’s a powerhouse example among the best mortgage websites.

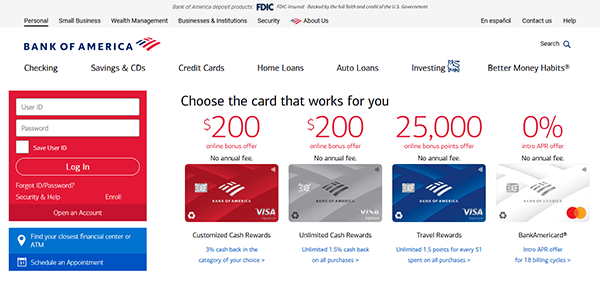

- Bank of America Mortgage: Bank of America’s mortgage portal is tailored to a wide range of buyers, from first-timers to seasoned homeowners looking to refinance. Visitors are greeted with a polished interface highlighting current interest rates and an immediate route to prequalification. A user-friendly design fosters trust and reassurance, with sections covering government-backed, jumbo, and specialized loan programs. Bank of America’s site also features a “Home Affordability Calculator” to help prospective clients better understand their financing capabilities. The blend of educational resources, professional imagery, and transparent product listings makes it a strong contender for mortgage broker websites.

- PennyMac: Its website showcases an approachable design emphasizing user guidance through the loan process. A streamlined menu structure leads visitors toward valuable resources, such as mortgage education tools and interest rate updates. They also feature specialized pages for VA and FHA loans, offering advice for veterans and first-time homebuyers, respectively. The site’s chat support function is especially noteworthy, ensuring quick communication and addressing customer concerns right away. Subtle animations and concise copy give the platform a modern feel, while the blog’s in-depth articles and expert tips position PennyMac as a trusted industry authority.

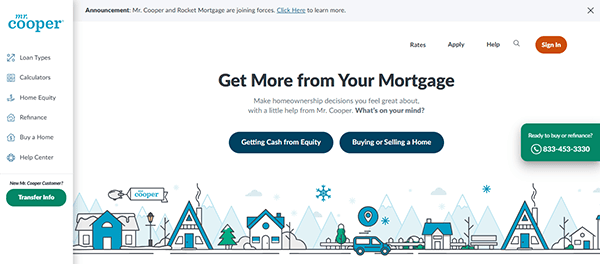

- Mr. Cooper: Mr. Cooper takes a friendly, personable approach to mortgage lending, which is evident from the website’s welcoming tone and visuals. The site employs approachable language throughout its pages, educating visitors on key mortgage terms and processes without being confusing. Clear calls to action encourage users to check rates or begin an application. Their “Loan Tracker” tool, which updates applicants on their loan status in real time, demonstrates a commitment to transparency. Combined with genuine testimonials, the entire layout fosters trust and confidence—an ideal model for mortgage websites aiming to build authentic relationships with clients.

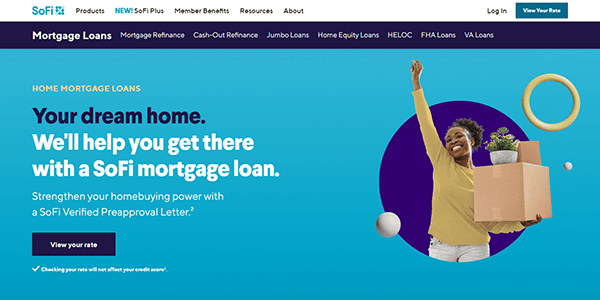

- SoFi Mortgage: SoFi gained recognition for its student loan solutions, but its mortgage division similarly stands out for its tech-savvy, millennial-friendly approach. The website conveys a modern aesthetic, focusing on bold typography and bright images that capture a sense of optimism. Users can easily navigate loan options for purchasing or refinancing and are provided instant access to helpful rate-checking tools. A side-by-side comparison of loan products assists borrowers in finding the right fit, and the site regularly features promotional rates to entice new buyers. The chat-based support and fully digital loan process illustrate how modern mortgage company websites can thrive.

- Caliber Home Loans: It offers a visually engaging website with a robust search function that lets users quickly check their eligibility for various mortgage products. Instead of burying information in menus, the homepage highlights key topics like purchasing a home, refinancing, and tips for first-time buyers. This approach makes the site accessible to borrowers at every stage. The “Find a Loan Consultant” feature pairs individuals with local experts, reflecting how mortgage broker websites can bridge digital convenience and personalized service. By mixing user-friendly navigation and educational content, Caliber fosters a supportive borrowing environment.

- U.S. Bank Mortgage: It offers an organized approach to finding the right loan, with segmented tabs highlighting different loan options. The design remains consistent and uncluttered, featuring quick links to “start an application” and “check current rates.” Their mortgage calculators range from general affordability to extra payment estimations, providing visitors with the precise tools to plan a financial future. New homebuyers can delve into thorough explanations of terms like “closing costs” and “PMI,” reducing the stress that often comes with the mortgage process. This comprehensive platform underlines U.S. Bank’s commitment to customer support and clarity.

- AmeriSave Mortgage: AmeriSave stands out for its “3-Minute Quote” application, which appears prominently on its homepage. This streamlined approach to gathering crucial borrower information helps visitors determine potential loan options without wading through extra steps. The site’s design balances vibrant visuals with simple text, emphasizing transparency about rates and fees. By also including sections for refinancing and specialty loans, AmeriSave ensures users can find tailored solutions. Their blog touches on real estate market trends, credit-building tips, and home-buying guides—further reinforcing how mortgage broker websites can play a more prominent role in educating consumers.

- NBKC Bank: NBKC Bank’s mortgage section is known for its competitive rates and user-centered digital application. The website ensures that prospective borrowers don’t get lost in overly technical jargon, strongly emphasizing plain-language explanations. They feature a sleek design accessible on any device, highlighting the company’s agile approach. NBKC also posts current rate ranges directly on their homepage, simplifying the process for visitors comparing various lenders. Their approach exemplifies how mortgage company websites can excel by offering transparency, excellent navigational structure, and a supportive tone to educate new and seasoned borrowers alike.

- CrossCountry Mortgage: CrossCountry Mortgage focuses on a wide variety of loan solutions, including conventional, VA, USDA, and FHA loans. The website places these offerings up front so users immediately understand the breadth of options available. Each loan page features brief eligibility requirements and key benefits, showing visitors a clear path forward. The site’s aesthetic leans toward minimalism, with ample white space and direct calls to action. It also contains a library of mortgage calculators and educational articles, ensuring that prospective clients have all the resources they need. This thorough and practical design puts CrossCountry among the best mortgage websites for consumers seeking clarity.

- CitiMortgage: Its mortgage portal integrates seamlessly with the broader Citi brand, offering a modern look aligned with its global banking profile. A straightforward interface welcomes borrowers to explore purchase or refinance options. Clear links guide them to check current rates, get prequalified, or schedule consultations with mortgage specialists. CitiMortgage also leverages digital tools like document uploads, e-signatures, and real-time loan tracking, simplifying every mortgage process step. The user support pages include frequently asked questions and contact details, reflecting how well-designed mortgage broker websites can reduce uncertainty and deliver top-tier customer care.

- Guild Mortgage: Guild Mortgage excels in offering diverse home loan solutions tailored to various income levels and home-buying needs. Their website highlights specialized lending options, including down payment assistance programs, which are critical for first-time homebuyers. The design employs a bright, clean layout with large buttons that direct visitors toward their primary goals—prequalifying, researching loan types, or requesting a quote. Scrolling through the homepage reveals customer testimonials and success stories that add credibility to the brand. Guild Mortgage showcases how mortgage company websites can cater to unique borrower segments while still maintaining a cohesive, professional online presence.

- Fairway Independent Mortgage: Fairway Independent Mortgage features a streamlined interface with clean lines, easy navigation, and a focus on building relationships. The site’s homepage directs visitors to simple paths—purchase, refinance, or calculate payments—ensuring that users find what they need without fuss. Educational videos, blog posts, and testimonials offer real-world insights into loan processes, creating a sense of trust. They also have a locator tool to connect prospects with nearby loan officers, humanizing the borrowing experience. By integrating these features into a neat design, Fairway underscores the importance of blending personalized service with digital accessibility.

- Wells Fargo: The Wells Fargo Mortgage webpage provides a professional and trustworthy experience for users. Its calming color scheme and clear calls to action, such as “Get Started” and “Check Rates,” guide users through the mortgage process. The well-organized layout includes informative sections with mortgage calculators and educational resources, and the intuitive navigation and responsive design ensure a smooth experience on any device. Overall, the page effectively combines visual appeal and functionality, allowing users to explore their mortgage options.

- Movement Mortgage: Its digital platform heavily emphasizes responsiveness and customer support. Their website has a lively, modern color scheme and bold typography, capturing attention without sacrificing usability. A concise menu points users to purchase, refinance, or specialized programs like USDA and VA loans. Movement Mortgage also invests in community-oriented content, highlighting charitable initiatives and corporate values. Visitors can use an interactive map to locate loan officers in their region, bridging online convenience with face-to-face expertise. Overall, it’s a strong example for mortgage broker websites aiming to build both brand loyalty and client satisfaction.

Designing one of the best mortgage websites involves clear communication, trustworthy branding, and valuable tools that reduce consumer anxiety about this vital financial undertaking. It’s not just about showcasing competitive rates but also delivering a memorable online experience that resonates with every visitor. Whether you specialize in first-time buyers, refinancing, or niche loan products, an optimized online presence helps you stand out in a crowded and highly regulated market.

As technology continues transforming the mortgage industry, staying current with web design trends and user experience best practices is crucial. Consider how you can integrate chatbots, personalized dashboards, and transparent rate displays to make your mortgage broker websites more engaging. Education remains a powerful way to build credibility—users appreciate articles, videos, and calculators that shed light on the entire loan journey.

If you want your mortgage company websites to reflect your expertise, trustworthiness, and dedication to excellent service, take inspiration from these outstanding platforms. By combining sleek design with practical functionality, you’ll be ready to convert more leads into satisfied homeowners.

Top 10 Important Aspects of a Mortgage Website

- Clear Calls to Action: Direct language and easy-access buttons encourage visitors to apply, get a quote, or learn more about specific loan products.

- Responsive Design: Ensuring compatibility across devices—smartphones, tablets, and desktops—so potential borrowers can explore loan options anywhere.

- Transparent Rate Information: Displaying up-to-date interest rates and fees builds trust and lets users make informed comparisons quickly.

- Loan Calculators and Tools: Providing interactive calculators, eligibility checkers, and comparison charts to engage users and offer immediate value.

- Educational Resources: Including articles, glossaries, and how-to guides alleviates confusion around mortgage processes and financial terminology.

- Easy Navigation: Organize menus and categories so visitors find relevant information quickly, without wading through unnecessary pages.

- Strong Visual Branding: Maintaining a consistent color palette and logo usage to bolster brand recognition and portray a sense of professionalism.

- Customer Testimonials and Reviews: Showcasing actual client experiences fosters credibility and reassures new visitors about the quality of your services.

- Secure Online Application Process: Protecting personal data through encrypted forms and verification methods to safeguard sensitive information.

- Accessible Support Channels: Implementing live chat, phone numbers, or email contact forms, providing prompt responses to inquiries and concerns.

FAQs About Mortgage Web Design

How can I make my mortgage website stand out from competitors?

Focus on delivering genuine value and transparency. Provide easy-to-use tools like loan calculators and ensure fast, intuitive navigation highlighting your unique offerings.

What platform is best for building a mortgage website?

WordPress is often recommended due to its flexibility, large community, and wide range of mortgage-specific plugins and themes that enhance functionality.

How much does it typically cost to design a mortgage website?

Basic websites can begin around $2,000 and increase depending on additional features such as integrated calculators, chatbots, and custom branding elements.

How often should I update my mortgage website?

It’s important to keep the site current, but don’t update it just to please Google. Instead, focus on improvements that add value for your visitors, such as fresh blog posts or new calculators.

Do I need to include compliance information on my mortgage website?

Yes, it’s essential to provide accurate disclosures and adhere to industry regulations, though specific requirements may vary by location and loan type.

Ready to elevate your mortgage’s website? Contact CyberOptik for a free proposal for your new mortgage website design and set your business up for success.