The insurance marketplace grows more competitive every day. As digital marketing specialists working with various industries, we’ve seen how the right marketing approach can transform an insurance agent’s business. Success today requires more than traditional networking and cold calls.

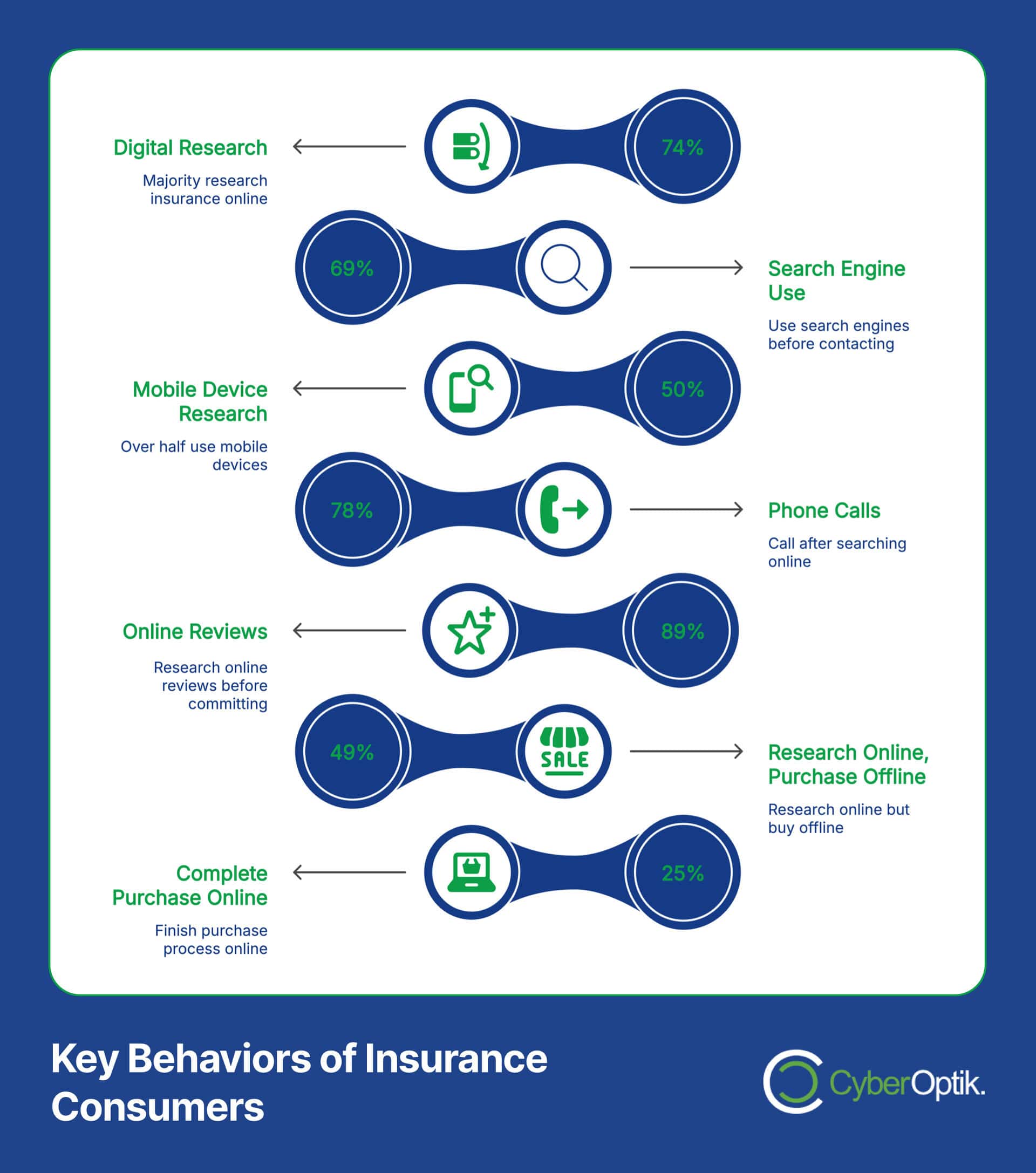

With research showing that 74% of consumers research insurance purchases online, but only 25% actually purchase online, agents need a strategic approach to capture and convert these digital researchers. (Source: Invoca)

In this comprehensive guide, we’ll explore proven marketing strategies specifically designed for insurance agents. These approaches help you attract more leads, build trust, and grow your client base.

Understanding Today’s Insurance Consumer Behavior

Modern insurance shoppers follow a distinct path. They research extensively online before making contact with an agent. Understanding this behavior forms the foundation of effective marketing.

Insurance consumers now start their journey with a search engine. In fact, 69% of insurance consumers run a search before scheduling an appointment with an agent. (Source: Invoca)

This digital-first approach changes how agents must position their services. Your online presence needs to capture attention at the research phase to ensure you’re considered when consumers reach the decision stage.

The following table highlights key insurance consumer statistics and what they mean for your marketing strategy:

| Consumer Behavior Statistic | Percentage | Marketing Implication |

|---|---|---|

| Insurance searches on mobile devices | Over 50% | Mobile optimization is essential |

| Consumers who call after searching | 78% | Phone call optimization crucial |

| Research online reviews before committing | 89% | Reputation management priority |

| Research online but purchase offline | 49% | Bridge digital-to-personal experience |

These statistics reveal important trends. Mobile usage dominates insurance research, making responsive websites essential. After online research, phone calls remain the preferred conversion path for most insurance shoppers. (Source: WebFX)

Understanding these behaviors helps you design marketing strategies that align with how your potential clients actually shop for insurance.

Essential Digital Marketing Strategies for Insurance Agents

Digital marketing offers insurance agents powerful tools to reach potential clients. The U.S. insurance industry recognizes this, projecting to spend over $15 billion on digital ads in 2024 alone. (Source: Invoca)

Let’s explore the most effective digital marketing channels for insurance agents.

Building an Optimized Insurance Agency Website

Your website serves as your digital office. It must make an excellent first impression. A professional, functional site builds credibility and converts visitors into leads.

The most effective insurance agency websites share these critical elements:

- Mobile responsiveness – With over 50% of insurance searches happening on mobile devices, your site must function perfectly across all screen sizes

- Fast loading times – Pages that load in under 3 seconds prevent visitor abandonment

- Clear contact information – Phone numbers should be prominently displayed and clickable on mobile

- Simple quote forms – Minimize required fields to increase completion rates

- Trust indicators – Display carrier logos, certifications, and customer testimonials

Website performance directly impacts lead generation. Slow, outdated, or confusing websites drive potential clients to competitors. A custom WordPress website provides the flexibility and functionality insurance agents need to showcase their services effectively.

Remember that phone calls convert to 10-15x more revenue than web leads for insurance agencies. Make your phone number highly visible on every page. (Source: Invoca)

Search Engine Optimization for Insurance Agents

SEO helps insurance agents appear in search results when potential clients look for insurance solutions. Local SEO proves especially valuable for independent agents serving specific geographic areas.

Effective insurance SEO requires patience and strategy. Start with these fundamentals:

Local SEO Essentials for Insurance Agents

Discover how proper local SEO implementation can significantly increase your agency’s visibility to clients searching in your service area.

Creating content that answers common insurance questions builds authority and attracts organic traffic. Topics like “How to choose the right coverage” or “Understanding policy limits” address real consumer concerns.

Insurance keywords can cost $50+ per click in paid campaigns, making organic ranking especially valuable for agents with limited marketing budgets. (Source: Invoca)

Effective PPC Advertising for Insurance Leads

Pay-per-click advertising delivers immediate visibility for insurance agents. These campaigns target specific keywords and demographics to reach potential clients actively searching for insurance.

The major platforms for insurance PPC include:

| PPC Platform | Best For | Key Advantage | Consideration |

|---|---|---|---|

| Google Ads Search | High-intent prospects | Immediate visibility in search results | High cost per click ($50+) |

| Google Local Service Ads | Local insurance agents | Google Guaranteed badge | Limited to certain locations |

| Facebook Ads | Demographic targeting | Advanced audience targeting | Lower purchase intent |

| LinkedIn Ads | Commercial insurance | Professional audience targeting | Higher cost per lead |

Insurance search ads convert at an average rate of 5.10%, compared to just 1.19% for display ads, making search the preferred channel for direct response campaigns. (Source: Invoca)

When creating PPC campaigns for insurance, focus on capturing phone calls. Since callers convert 30% faster than web leads, optimizing for call conversions often delivers better ROI than form submissions. (Source: Bankrate)

Building Trust and Authority as an Insurance Agent

Trust forms the foundation of the agent-client relationship. Unlike many products, insurance represents a promise of future protection that clients must believe you’ll deliver.

Building trust happens through consistent communication and demonstration of expertise. Digital channels offer multiple ways to establish yourself as a trusted authority.

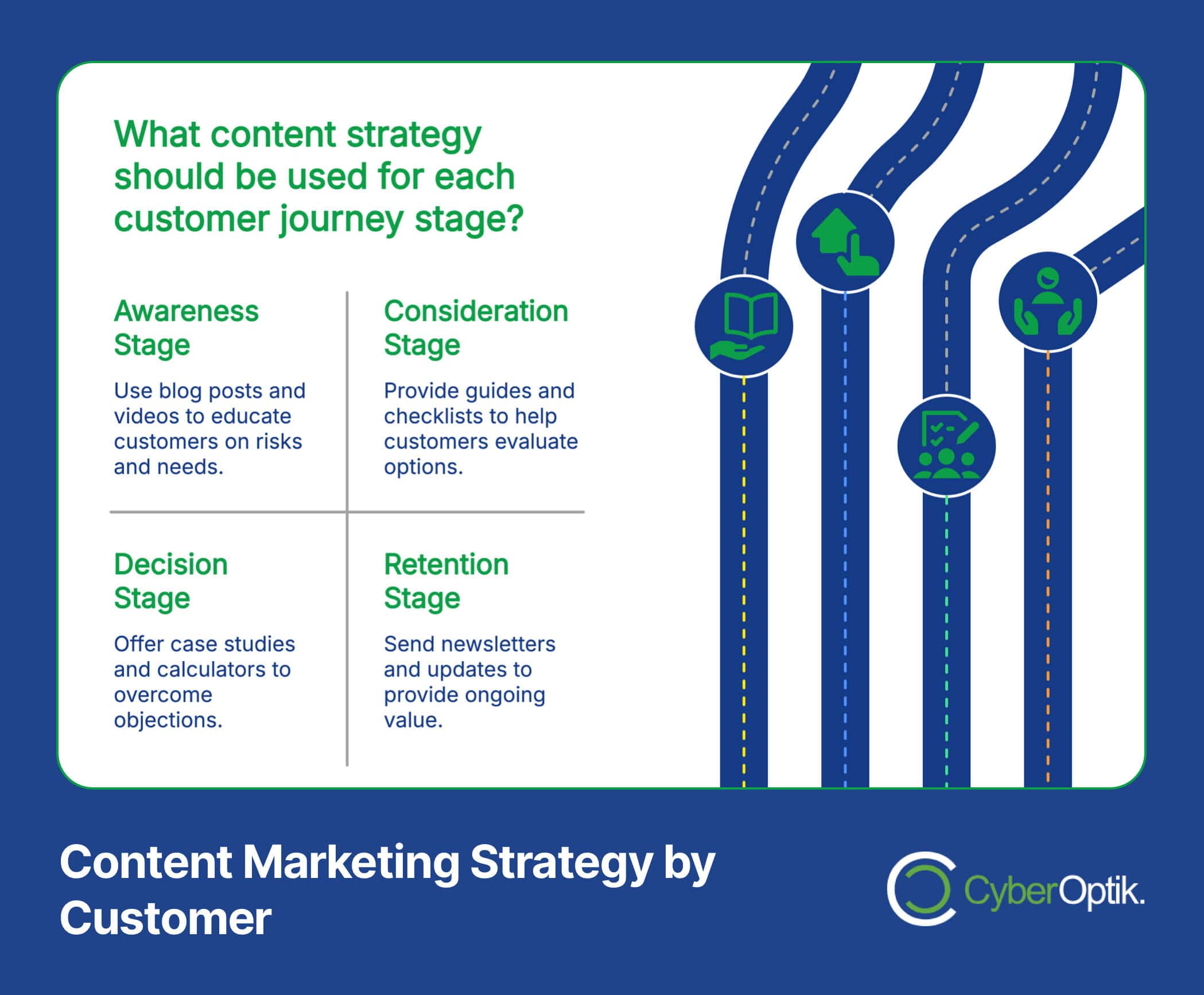

Content Marketing for Insurance Expertise

Content marketing helps insurance agents demonstrate expertise while providing value to potential clients. This builds credibility and generates organic traffic to your website.

The most effective content addresses specific questions and concerns your target clients have about insurance. The table below shows content types that work at different stages of the customer journey:

| Journey Stage | Content Type | Goal | Example Topic |

|---|---|---|---|

| Awareness | Blog posts, videos | Educate on risks/needs | "5 Risks Homeowners Often Overlook" |

| Consideration | Guides, checklists | Help evaluate options | "How to Compare Home Insurance Policies" |

| Decision | Case studies, calculators | Overcome objections | "How Our Agency Saved a Client $1,200" |

| Retention | Newsletters, updates | Provide ongoing value | "New State Laws Affecting Your Coverage" |

Creating content that explains complex insurance concepts in simple terms positions you as an expert guide. This builds trust before a potential client ever contacts you.

Professional copywriting enhances the effectiveness of your content by ensuring it’s engaging, clear, and optimized for both readers and search engines.

Leveraging Reviews and Testimonials

Reviews significantly impact insurance purchasing decisions. A staggering 89% of customers research online reviews before committing to an insurer, making reputation management essential. (Source: Invoca)

Positive reviews provide social proof that builds confidence in potential clients. They address the most common question in a prospect’s mind: “Can I trust this agent?”

Implement these strategies to build a strong online reputation:

- Create a systematic process for requesting reviews after positive interactions

- Make it easy by sending direct links to your Google Business Profile

- Respond promptly and professionally to all reviews, especially negative ones

- Feature testimonials prominently on your website and marketing materials

Managing your Google Business Profile properly ensures that when potential clients search for insurance in your area, they see not just your name but also positive ratings that differentiate you from competitors.

Client Retention and Referral Strategies

Acquiring new insurance clients costs significantly more than retaining existing ones. Effective retention strategies protect your client base while maximizing lifetime value.

The statistics support this approach. The caller retention rate is 28% higher than web lead retention rate, emphasizing the importance of personal connection in building lasting client relationships. (Source: Invoca)

Let’s explore the most effective client retention and referral strategies for insurance agents.

Email Marketing for Insurance Client Nurturing

Email marketing provides a direct communication channel with your clients. Regular, valuable communications keep your agency top-of-mind and strengthen relationships.

Effective insurance email marketing includes:

| Email Type | Purpose | Frequency | Content Examples |

|---|---|---|---|

| Welcome Sequence | Onboard new clients | Series of 3-5 emails | Policy details, online account setup, contact information |

| Newsletters | Provide ongoing value | Monthly | Insurance tips, local events, team updates |

| Renewal Reminders | Prevent lapses | 60, 30, 15 days before | Policy review offers, payment options, coverage updates |

| Life Event Triggers | Cross-sell opportunities | Based on events | New home congratulations, college planning, retirement |

Personalization dramatically improves email performance. Segment your list by policy type, life stage, or renewal date to deliver relevant content to each client.

Creating a Referral System That Works

Referrals represent the highest-quality leads for insurance agents. These prospects come with built-in trust transferred from your existing clients.

Independent agents control 52% of the personal life insurance market (up from 46% in 2014), demonstrating the power of relationship-based business models in insurance. (Source: Insurance Information Institute)

A systematic referral program includes these key elements:

- Timing – Ask for referrals after positive experiences (claim resolution, policy savings)

- Incentives – Offer meaningful rewards that reflect the value of a new client

- Simplicity – Make the referral process easy with digital options

- Recognition – Thank clients for referrals, regardless of outcome

- Follow-up – Keep referring clients informed about the status of their referrals

Many successful insurance agents build their entire business on referrals. The key lies in making referrals a systematic part of your process rather than an occasional afterthought.

Measuring Insurance Marketing Success

Effective marketing measurement helps insurance agents allocate resources to the most productive channels. Track these key metrics to evaluate your marketing performance:

| Marketing Metric | What It Measures | Target Benchmark | Improvement Action |

|---|---|---|---|

| Cost Per Lead (CPL) | Acquisition efficiency | Industry: $30-120 | Optimize ad targeting, improve landing pages |

| Lead-to-Client Conversion | Sales effectiveness | Industry: 10-20% | Improve follow-up process, enhance qualifying |

| Client Retention Rate | Relationship strength | Industry: 84% | Implement proactive touch points, resolve issues |

| Client Lifetime Value | Long-term profitability | Varies by niche | Increase cross-selling, improve retention |

With 927,600 licensed insurance agencies and brokers in the U.S., standing out requires not just implementing marketing tactics but measuring and optimizing them. (Source: Agent Methods)

Technical SEO implementation allows proper tracking of these metrics through analytics tools, ensuring you have accurate data for decision-making.

Implementing Your Insurance Marketing Strategy

The most successful insurance agents use integrated marketing strategies that work together. Each element reinforces the others, creating a consistent presence across multiple channels.

Medicare Advantage ads accounted for 86% of Medicare-related TV ads during open enrollment, showing how dominant players focus intensively on specific niches rather than trying to be everything to everyone. (Source: KFF)

Begin implementing these strategies by focusing on fundamentals. Start with your website and Google Business Profile, then expand to content creation and paid advertising as resources allow.

We recommend these action steps to move forward:

- Audit your current online presence to identify gaps and opportunities

- Develop a mobile-friendly website optimized for lead generation

- Create a content calendar focused on answering common client questions

- Implement a systematic review collection process

- Track key metrics and adjust your strategy based on results

With insurance premiums in the U.S. exceeding $1 trillion annually, effective marketing strategies help you capture your share of this substantial market. (Source: WebFX)

Remember that marketing success requires consistency and patience. The strategies outlined here work together over time to build a sustainable competitive advantage for your insurance agency.

Need help implementing your insurance agency marketing strategy? Our team specializes in creating websites that drive leads for service businesses. Contact us to discuss how we can help grow your insurance agency.