Trust forms the foundation of successful financial advisory services. In an industry where clients entrust their financial future to advisors, establishing credibility and fostering relationships directly impacts practice growth. Marketing for financial advisors requires a delicate balance between promoting services and demonstrating trustworthiness.

Today’s financial advisors face unique marketing challenges. From standing out in a crowded marketplace to adapting to changing client expectations, advisors need strategic approaches that build both visibility and trust. The right marketing strategies not only attract new clients but strengthen relationships with existing ones.

In this guide, we’ll explore effective marketing strategies specifically for financial advisors. We’ll cover trust-building techniques, client acquisition tactics, digital marketing approaches, and integrated multi-channel strategies—all designed to help you grow your practice while maintaining the highest professional standards.

Understanding the Financial Advisor Marketing Industry

The financial advisory landscape has transformed dramatically in recent years. Client expectations have evolved, competition has intensified, and digital marketing has become essential rather than optional. Successful advisors recognize that marketing isn’t just about acquisition—it’s about building lasting relationships.

Most financial advisors understand the importance of marketing but struggle with implementation. A striking 77% of advisors lack a clear marketing strategy, despite evidence showing its impact on growth.

Having a defined marketing approach yields measurable results. Advisors with structured marketing strategies onboard 50% more clients annually than those without formal plans. (Source: SmartAsset) This significant difference highlights the importance of strategic planning rather than ad-hoc marketing efforts.

The most successful advisors understand that effective marketing starts with knowing what influences client decisions. Research consistently shows that trust ranks as the primary factor when prospects choose a financial advisor. Digital presence follows closely, with 81% of potential clients checking advisors online before initial meetings. (Source: Financial Planning)

The Cost and ROI of Financial Advisor Marketing

Marketing investments vary widely across the industry. The average financial advisor marketing spend in 2024 was $15,908, with team practices investing substantially more ($23,200) than solo practitioners ($9,000). (Source: SmartAsset)

Understanding the return on these investments helps advisors allocate resources effectively. Not all marketing channels deliver equal value. Referrals consistently provide the highest ROI, with an average acquisition cost of $609 per client—significantly lower than most digital acquisition methods. (Source: SmartAsset)

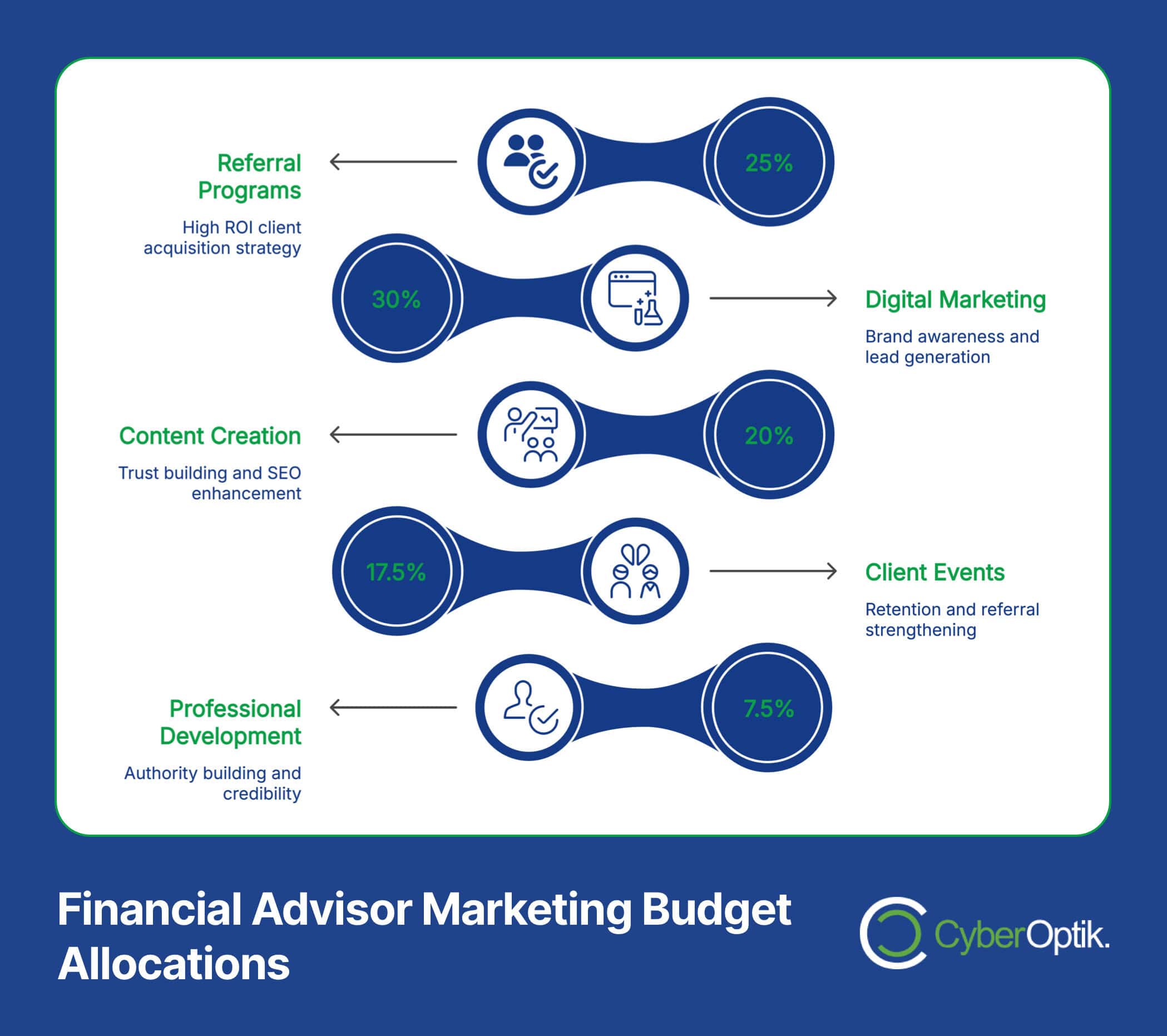

Effective marketing budgeting requires balancing immediate lead generation activities with long-term relationship building. We recommend financial advisors allocate resources across both categories, with the specific mix depending on practice maturity and growth goals.

| Marketing Activity | Budget Allocation Range | Primary Purpose | Time to Results |

|---|---|---|---|

| Referral Programs | 20-30% | Client Acquisition | 1-3 months |

| Digital Marketing | 25-35% | Brand Awareness & Lead Generation | 3-6 months |

| Content Creation | 15-25% | Trust Building & SEO | 6-12 months |

| Client Events | 15-20% | Retention & Referrals | Immediate to 3 months |

| Professional Development | 5-10% | Authority Building | 6-12 months |

This balanced approach ensures both immediate results and sustainable practice growth. Adjustments should be made based on measured performance and specific business goals.

Trust-Building Marketing Strategies for Financial Advisors

Trust forms the cornerstone of successful financial advisory relationships. Without it, even the most sophisticated investment strategies or comprehensive financial plans will fail to retain clients. The importance of trust cannot be overstated: 54% of clients who left their advisors in 2023 cited trust issues as a key driver. (Source: Russell Investments)

Building trust isn’t just about retaining existing clients—it’s essential for attracting new ones. When prospective clients evaluate potential advisors, they’re looking for signals of trustworthiness. These signals appear throughout your marketing materials, online presence, and initial consultations.

We’ve found that effective trust-building marketing conveys both competence and warmth. Technical expertise alone isn’t enough; clients need to feel you understand their unique needs and genuinely care about their financial well-being.

Developing a Connection-First Approach

Client relationships begin with connection. Research shows that 75% of clients prioritize “developing a connection/relationship” as their top service need—even above investment performance or financial planning. (Source: Investopedia)

Creating this connection requires demonstrating that you understand clients’ specific concerns and financial goals. Marketing materials should reflect this understanding through personalized messaging, relevant content, and clear communication of your advisory approach.

Fiduciary commitment represents another powerful trust-building element. When advisors clearly explain their fiduciary duty to act in clients’ best interests, it significantly improves confidence and retention. This commitment should be prominently featured in marketing materials, website content, and client conversations.

Transparency and Communication Strategies

Regular, proactive communication forms the foundation of trust-based relationships. Advisors who communicate quarterly with clients report greater confidence in meeting client goals and stronger retention rates. (Source: Wharton/State Street Report)

Communication breakdowns, particularly unreturned calls or emails, quickly erode trust in the early stages of client relationships. Establishing clear communication expectations and consistently meeting them helps prevent these issues and builds confidence in your reliability.

Transparency about fees, investment approaches, and potential conflicts of interest forms another essential trust component. Clients appreciate straightforward explanations and honest discussions about limitations or risks. This transparency should be reflected in all marketing materials and client-facing documents.

| Trust-Building Element | Implementation in Marketing | Client Impact | Practical Examples |

|---|---|---|---|

| Communication Consistency | Establish and maintain regular touchpoints | Increased confidence, stronger retention | Quarterly review emails, monthly newsletters, annual planning sessions |

| Transparency | Clear disclosure of fees, processes, and limitations | Builds credibility and reduces skepticism | Fee structure page on website, process explanation videos, limitations acknowledgment |

| Fiduciary Commitment | Prominently feature fiduciary status and commitment | Differentiates from non-fiduciary advisors | Fiduciary pledge on homepage, explanation in client materials, certification displays |

| Education Focus | Provide valuable information without immediate selling | Demonstrates expertise and client-first mindset | Educational blog posts, free webinars, explanatory resources |

| Social Proof | Showcase authentic client experiences | Validates claims and builds confidence | Client testimonials, case studies, reviews (where compliant) |

Implementing these trust-building elements throughout your marketing creates a foundation for successful client relationships. Trust established early through marketing carries through to client interactions and strengthens long-term retention.

Client Acquisition Tactics That Work for Financial Advisors

Acquiring new clients requires a strategic approach tailored to the unique nature of financial advisory services. Unlike product-based businesses, advisors sell expertise, guidance, and relationship—elements that require specialized acquisition tactics.

Effective client acquisition starts with understanding which channels deliver the best results. While digital marketing continues to grow in importance, traditional relationship-based methods still drive the majority of new business for financial advisors.

The most successful advisors employ multiple acquisition channels while recognizing that some deliver significantly better results than others. By focusing resources on the highest-performing methods, advisors can maximize growth while controlling acquisition costs.

Creating a Referral-Driven Practice

Referrals remain the dominant client acquisition channel for financial advisors, with 93% of advisors gaining new clients through this method. (Source: SmartAsset) This overwhelming percentage highlights the critical importance of referral marketing for practice growth.

The economics of referral marketing make it particularly attractive. The average client acquisition cost for referrals is $609—substantially lower than most digital marketing channels. These referred clients also typically show higher retention rates and greater assets under management than clients acquired through other methods.

Building a systematic referral program requires more than occasionally asking for introductions. Successful advisors create structured processes that make referrals a natural extension of client relationships. This includes identifying ideal referral opportunities, making specific requests, and providing tools that make it easy for clients to refer others.

| Referral Program Element | Purpose | Implementation Tips | Common Mistakes |

|---|---|---|---|

| Timing Strategy | Request referrals when clients are most satisfied | After successful reviews, problem resolution, or milestone achievements | Asking too early in relationship or during market downturns |

| Specific Requests | Make it easy for clients to identify potential referrals | Describe ideal client profile, specify professions or situations | Vague "do you know anyone" requests that lack specificity |

| Client Education | Help clients understand your ideal client and services | Create simple guides explaining who benefits most from your expertise | Assuming clients know who would benefit from your services |

| Recognition System | Show appreciation for referrals (compliance-appropriate) | Thank you notes, appropriate gifts, recognition events | Failing to acknowledge referrals or appreciate the client's trust |

| Referral Tracking | Monitor referral sources and conversion rates | Use CRM to track referral source, conversion, and client value | Not measuring referral program effectiveness or identifying top referrers |

A well-executed referral program becomes self-reinforcing. As you serve referred clients well, they in turn become sources of additional referrals, creating sustainable growth.

Effective Digital Marketing for Financial Advisors

While relationship-based marketing drives most new business, digital marketing has become essential for financial advisors. A strong digital presence serves multiple purposes: it validates your credibility with referred prospects, generates organic leads, and builds your brand authority.

Website optimization stands as the foundation of digital marketing for financial services. Your website often creates first impressions, with 81% of potential clients checking advisors online before making contact. (Source: Financial Planning) A professional, user-friendly site that clearly communicates your value proposition is no longer optional.

Search engine optimization (SEO) helps potential clients find you when researching financial topics or seeking advisors. Focusing on local SEO proves particularly effective for advisors serving specific geographic areas. Educational content that addresses common financial questions not only improves search visibility but demonstrates expertise.

Content marketing through blogs, videos, podcasts, and downloadable resources serves dual purposes. It improves search rankings while showcasing your knowledge and approach. The most effective content addresses specific client questions or concerns, positioning you as a trusted resource rather than just a service provider.

Digital marketing for financial advisors requires balancing modern techniques with industry compliance requirements. All digital content must adhere to regulatory guidelines while still engaging potential clients effectively.

Content Marketing Strategies for Financial Advisors

Content marketing has emerged as a powerful tool for financial advisors seeking to demonstrate expertise, build trust, and generate leads. Unlike traditional advertising, content marketing focuses on providing value before asking for commitment—an approach particularly well-suited to the advisory business.

Effective content establishes your credibility and showcases your unique perspective on financial matters. It helps potential clients understand your approach and philosophy before they ever contact you. This pre-relationship positioning significantly improves conversion rates when prospects do reach out.

The most successful advisors use content strategically throughout the client acquisition journey. Different content types serve various purposes—from awareness and education to consideration and decision support. This intentional approach creates a content ecosystem that nurtures prospects toward becoming clients.

Developing Educational Content That Converts

Educational content forms the core of effective advisor marketing strategies. By providing genuine value through informative resources, you demonstrate both expertise and client-first mindset—two essential trust factors.

Content development should begin with understanding your ideal clients’ questions, concerns, and information needs. The most effective topics address specific pain points or knowledge gaps related to the financial challenges your target audience faces.

Format diversity helps reach different audience preferences. While some prospects prefer reading blog posts or articles, others may engage better with videos, podcasts, or interactive tools. Creating cornerstone content that can be repurposed across formats maximizes your investment while reaching more potential clients.

Here are several high-performing content formats for financial advisors:

- Blog posts and articles – Address specific financial questions or concerns in depth

- Video content – Explain complex concepts visually or showcase your personality and approach

- Webinars – Provide interactive education on financial topics relevant to your target clients

- Downloadable guides – Offer comprehensive resources in exchange for contact information

- Podcasts – Build connections through regular audio content on financial topics

The best financial content balances educational value with strategic business goals. Every piece should include appropriate calls-to-action that guide interested readers toward the next step in your client acquisition process.

Lead Generation Through Valuable Content

Converting content consumers into leads requires strategic planning. Each content piece should include thoughtfully designed conversion elements that capture information from engaged prospects.

Lead magnets—valuable downloadable resources offered in exchange for contact information—serve as effective conversion tools. These might include financial planning worksheets, retirement readiness checklists, or specialized guides addressing specific life transitions like inheritance or business succession.

Effective lead nurturing follows initial content engagement. Email sequences that provide additional value while gradually introducing your services help move prospects from casual readers to consultation requests. These sequences should be personalized based on the specific content that initially captured the lead’s interest.

| Content Type | Lead Generation Approach | Nurturing Strategy | Conversion Goal |

|---|---|---|---|

| Blog Posts | Newsletter signup, related guide downloads | Topically related email content series | Educational webinar registration |

| Educational Videos | Subscription, companion resource downloads | Video series progression with increasing specificity | Free assessment or consultation offer |

| Downloadable Guides | Form submission for high-value resource | Follow-up emails with additional insights on topic | Specialized consultation related to guide topic |

| Webinars | Registration collects contact information | Pre-event and post-event targeted content | Limited-time consultation offer for attendees |

| Financial Tools | Registration for calculator or assessment access | Results-based recommendations and resources | Results review consultation offer |

Content-based lead generation works because it attracts prospects already interested in relevant financial topics. These warm leads typically convert at significantly higher rates than those from interruptive advertising methods.

Implementing a Multi-Channel Marketing Approach

Today’s most successful financial advisors implement integrated marketing strategies across multiple channels. This coordinated approach ensures consistent messaging while maximizing reach through prospects’ preferred platforms.

A multi-channel strategy recognizes that potential clients consume information through various mediums. Some may discover you through LinkedIn content, while others might find your website through a Google search for local financial advisors. By maintaining presence across relevant channels, you increase opportunities for meaningful connection.

The key to effective multi-channel marketing lies in integration rather than isolation. Each channel should support and reinforce the others, creating a cohesive experience as prospects move between platforms. This integration amplifies your message while providing multiple touchpoints that build familiarity and trust.

Social Media Strategies for Financial Advisors

Social media presents both opportunities and challenges for financial advisors. When implemented strategically, it builds visibility, demonstrates expertise, and facilitates relationship development. However, poorly executed social media efforts yield minimal returns and potentially damage credibility.

Platform selection should reflect both your target audience demographics and content strengths. LinkedIn consistently delivers the strongest results for most financial advisors, particularly those focusing on professional or pre-retiree clients. Facebook may prove valuable for advisors targeting specific communities or family-oriented planning services.

Content strategy varies significantly between platforms. LinkedIn rewards substantive thought leadership content and professional insights. Facebook engagement comes through more personal, relatable content that connects financial concepts to everyday life. Regardless of platform, educational content typically outperforms promotional messages for financial services.

Compliance considerations remain essential in all social media activities. Having clear policies regarding acceptable content, approval processes, and record-keeping helps navigate regulatory requirements while maintaining an effective social presence.

Email Marketing Best Practices

Email marketing provides direct access to prospects and clients, making it one of the most valuable channels for financial advisors. When executed properly, email builds relationships through consistent, valuable communication.

Segmentation significantly improves email effectiveness. By dividing your audience based on client status, interests, life stage, or service needs, you can deliver highly relevant content that resonates with specific recipient groups. This relevance dramatically improves open rates, engagement, and conversion.

Content variety keeps email communications engaging. A mix of educational pieces, market updates, practice news, and occasional promotional messages creates a balanced approach that provides value while advancing business goals. The most successful advisors maintain approximately an 80/20 ratio of educational to promotional content.

Regular measurement helps optimize email performance over time. Tracking open rates, click-through rates, and conversion actions identifies what resonates with your audience. This data should inform ongoing refinements to subject lines, content topics, sending frequency, and calls-to-action.

| Marketing Channel | Primary Purpose | Content Approach | Integration Strategies |

|---|---|---|---|

| Website | Information hub, credibility builder | Professional presentation, service details, educational resources | Central destination for all other channel links; conversion point |

| Professional networking, thought leadership | Industry insights, professional accomplishments, educational content | Share website content; connect with prospects; showcase expertise | |

| Nurturing relationships, direct communication | Personalized information, timely updates, exclusive insights | Drive traffic to website; follow up on social engagement; regular touchpoint | |

| Blog | SEO, expertise demonstration | In-depth educational pieces, timely financial insights | Content source for social and email; SEO driver to website |

| Video | Personality showcase, complex concept explanation | Educational pieces, process explanations, client testimonials | Embed on website; share on social; include in email newsletters |

Effective channel integration creates a seamless experience as prospects and clients interact with your practice across different platforms. This consistency reinforces your message and builds the familiarity that leads to trust.

Measuring and Optimizing Your Marketing Efforts

Effective marketing for financial advisors requires ongoing measurement and optimization. Without proper tracking, it’s impossible to determine which strategies deliver results and which consume resources without adequate return.

Establishing clear metrics before implementing marketing activities creates accountability and focus. These metrics should align with business objectives—whether generating new leads, increasing assets under management, or improving client retention. The most valuable measurements track outcomes (new clients, increased assets) rather than just activities (posts published, emails sent).

Regular performance reviews should inform ongoing strategy adjustments. This data-driven approach allows for resource reallocation from underperforming channels to those generating better results. It also reveals opportunities for refining messaging, targeting, or conversion processes to improve overall effectiveness.

Essential KPIs for Financial Advisor Marketing

Key performance indicators provide insight into marketing effectiveness at each stage of the client journey. Tracking these metrics helps identify both strengths and potential improvement areas in your marketing system.

Awareness metrics measure your visibility to potential clients. These include website traffic, search rankings for target keywords, social media reach, and brand recognition. While these top-of-funnel metrics don’t directly measure business impact, they indicate whether your marketing is reaching your target audience.

Engagement metrics reveal how prospects interact with your content and messages. Metrics like email open rates, content consumption patterns, social media engagement, and website behavior help determine which topics and formats resonate with your audience. This information guides content development and refinement.

Conversion metrics track when prospects take meaningful steps toward becoming clients. Monitoring consultation requests, lead magnet downloads, webinar registrations, and similar actions helps evaluate your success in moving prospects through the decision journey. These metrics directly connect marketing activities to business outcomes.

Adjusting Strategies Based on Results

Marketing optimization requires both systematic testing and responsive adjustments. Regular A/B testing of key elements—subject lines, calls-to-action, content formats, sending times—reveals which variations perform best with your specific audience.

Performance trends should drive resource allocation decisions. Channels or tactics showing consistent results deserve increased investment, while underperforming approaches require either refinement or replacement. This performance-based allocation maximizes marketing ROI over time.

Competitive analysis provides additional optimization insights. Regularly reviewing competitor messaging, content approaches, and digital presence helps identify both opportunities and potential threats. This ongoing assessment ensures your marketing remains differentiated and effective in an evolving landscape.

| Marketing Metric | What It Measures | Target Benchmark | Optimization Actions |

|---|---|---|---|

| Website Conversion Rate | Percentage of visitors who take desired actions | 2-5% for financial advisor sites | Improve calls-to-action, streamline forms, add social proof |

| Client Acquisition Cost | Marketing spend divided by new clients acquired | Varies by client value (typically $1,000-$3,000) | Optimize underperforming channels, enhance referral programs |

| Email Engagement Rate | Combined open and click-through performance | 20-30% open rate, 2-5% click-through rate | Improve subject lines, enhance content relevance, refine segmentation |

| Content Effectiveness | Lead generation from specific content pieces | Relative comparison between content assets | Create more of high-performing content types, improve conversion elements |

| Referral Conversion Rate | Percentage of referrals who become clients | 40-60% for warm referrals | Improve follow-up process, enhance referral qualification |

Establishing a regular optimization routine ensures continuous marketing improvement. Monthly metric reviews, quarterly strategy assessments, and annual comprehensive evaluations create a structured approach to ongoing refinement.

Creating Your Financial Advisor Marketing Plan

Developing a structured marketing plan transforms random activities into strategic growth drivers. A well-designed plan aligns marketing efforts with business objectives while creating accountability for implementation and results.

Effective marketing plans balance aspiration with reality. They establish meaningful objectives while acknowledging resource constraints and compliance requirements unique to financial services. The most successful plans include clear priorities, specific responsibilities, and realistic timelines.

Implementation often presents the greatest challenge for financial advisors. Day-to-day client service frequently takes precedence over marketing activities. Creating systems, establishing routines, and potentially delegating certain tasks helps ensure consistent execution despite competing priorities.

Begin with a clear assessment of your current situation. Before developing new strategies, evaluate your existing client base, referral sources, service offerings, and competitive positioning. This baseline understanding informs realistic goal-setting and strategy development.

Identify specific, measurable objectives that align with business goals. Rather than vague aspirations like “increase clients,” establish concrete targets such as “add 12 new clients meeting our ideal profile” or “increase AUM by 20% through existing client development and new client acquisition.”

Select appropriate strategies based on your practice model and target clients. Solo advisors with established client bases might emphasize referral programs and existing client development. Growing firms may focus more on digital presence and lead generation systems. Early-stage practices often benefit from network development and strategic partnerships.

Develop a realistic implementation timeline with specific responsibilities. Break larger initiatives into manageable tasks with clear ownership and deadlines. This detailed approach prevents important activities from falling through the cracks during busy periods.

Include budget allocations that reflect your priorities. Resource constraints require making tradeoffs between different marketing activities. Allocate your marketing budget based on anticipated effectiveness for your specific situation rather than simply copying industry averages.

Establish measurement systems before implementation begins. Determine how you’ll track both activities and outcomes for each marketing initiative. This accountability creates the feedback loop necessary for ongoing optimization.

Review and adjust regularly as results emerge. Quarterly assessment of key metrics allows for timely course corrections while maintaining overall strategic direction. Annual comprehensive reviews provide opportunities for larger strategic shifts based on changing business goals or market conditions.

Conclusion

Effective marketing for financial advisors requires balancing relationship development with strategic promotion. The approaches outlined in this guide—from trust-building techniques to digital strategies and measurement systems—provide a framework for growing your practice while maintaining the highest professional standards.

Remember that marketing success stems from consistency rather than perfection. Implementing a few strategies well and sustaining them over time typically yields better results than attempting numerous approaches without follow-through. Start with the methods most aligned with your practice model and client base, then expand gradually as you build momentum.

We help financial advisors develop and implement marketing strategies that build trust while driving practice growth. Our specialized knowledge of both digital marketing and financial services allows us to create compliant, effective approaches tailored to your specific business goals. Contact us to discuss how we can support your practice’s marketing needs.